A word about residential prices in Dublin.

Now that we’ve got our new lovely property price register, it’s suddenly quite easy for everyone to become a statistician (the author is no different).

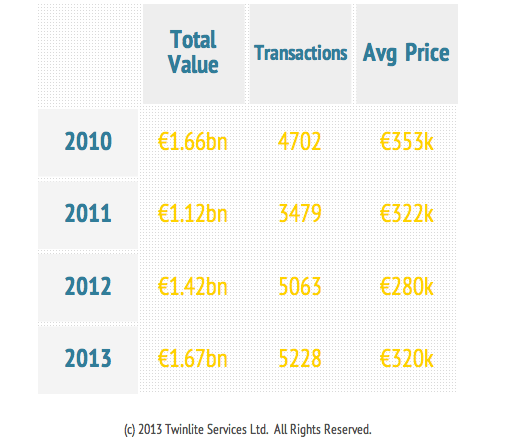

From a very simple analysis, Jan 1 – Sep 9 during ’12 and ’13 (the latest date 2013 data is available for) there was a noticeable uptick in both transaction and value:

Now, these numbers are not 100% accurate. For a start, some of the price data on the property register has deliberate omissions, in the case of new homes the element that forms the VAT on the sale of the house is excluded (which is a little unfair in my view as the purchaser pays the price inclusive of VAT) and also there are cases where the full purchase price is not paid at the time of sale (such as deferred sale agreements or profit shares). That being said, these exclusions make up a very small percentage of total transactions so we will gleefully ignore them for now.

A simple look at the table above would point to the low point of the property market (in Dublin) as being in 2011, not 2012 as many (including me) have said. Transactions (in total value and in total number) were lowest in 2011 of the 4 years, though the average price was higher than the same period in 2012 and 2013.

Furthermore, logically it would seem that as transaction levels pick up, the average price should fall slightly, this is because as the market improves and presumably mortgage availability (albeit slightly) improves with it, lower value transactions are also going to pick up. It is no secret that the market of the last few years has been dominated by the ‘cash’ buyer, and these parties typically were purchasing higher priced property, which kept average prices up. In addition, the perceived strength of the housing market recovery has meant that property that previously would have been difficult to sell at all is now attracting at least some form of market. This lower priced property could be holding down the average price.

No matter when the bottom was, it seems relatively clear that there is a trend upwards now and that some form of recovery has started. The big question, that nobody can answer, is whether or not it will last. Of course time will tell, but the biggest factor (like in any market) will be supply and demand. Demand is subdued, mortgage availability is very tight and the job market, while improving, is still dire. Supply, however, is even tighter. New home building is at an all time low. Finance for building companies does not exist and given what happened in the last few years, there are very few developers not entwined in some sort of Bank directed restructuring. This is a big factor that many are ignoring. Building is not simple work, and without experience players in the market developing sites, supply will remain constrained for possibly several years. This will have a much bigger impact on prices than the jobs market or the subdued level of mortgage availability.

I’ll revisit the data at year-end to see if the full year picture is any different.

PS – for anyone who is interested (or too lazy to download it themselves) the raw data from the Property Price register is here: PPR-Dublin